SOL Price Prediction: Can Institutional Adoption Push SOL to $300?

#SOL

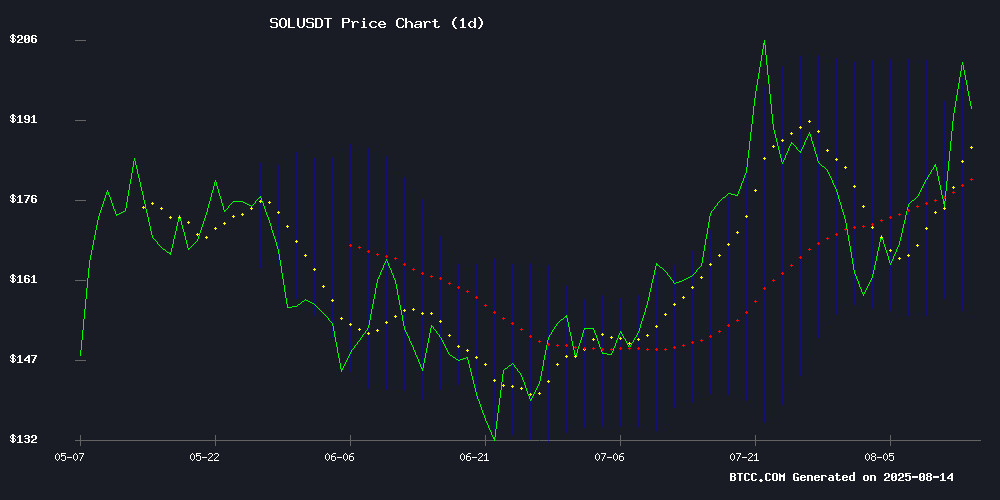

- Technical Strength: Price holds above key MA with Bollinger Band expansion

- News Catalyst: Institutional adoption and Solana ecosystem growth dominate headlines

- Price Target: $270 appears more probable than $300 in current market structure

SOL Price Prediction

SOL Technical Analysis: Bullish Momentum Builds Above Key Moving Averages

SOL is currently trading at $209.42, significantly above its 20-day moving average of $178.26, indicating strong bullish momentum. The MACD shows a bearish crossover with the signal line above the MACD line (-3.6953), suggesting potential short-term consolidation. However, the price remains NEAR the upper Bollinger Band ($203.72), which often acts as resistance. A sustained break above this level could signal further upside.

Market Sentiment: Institutional Demand and Ecosystem Growth Fuel SOL Rally

Positive news FLOW surrounds SOL, with headlines highlighting institutional adoption, ETF speculation, and ecosystem developments like Unich's pre-TGE trading platform. Multiple articles note SOL breaking $200 resistance, with price targets extending to $270. While minor mentions of support tests exist, the dominant narrative focuses on altcoin season momentum and whale accumulation.

Factors Influencing SOL’s Price

Unich Aims to Revolutionize Pre-TGE Token Trading on Solana

Pre-TGE token trading has surged in popularity, offering high-speed transactions but carrying significant risks. Unich emerges as a solution, leveraging Solana's blockchain to enhance safety and transparency in over-the-counter crypto trades. The platform employs smart contracts to mitigate fraud, particularly in pre-TGE token deals.

Solana's infrastructure proves pivotal, with its capacity for 65,000 transactions per second and negligible fees. Recent data from Defillama highlights Solana's growing dominance, recording daily volumes of $3.4 billion. Projects like Pumpfun and Raydium have already demonstrated Solana's potential, with Raydium processing $16 billion in trades during the meme-coin frenzy.

Unich's integration with Solana ensures rapid, cost-effective transactions, addressing the volatility and uncertainty inherent in pre-TGE markets. The platform's design prioritizes user experience, offering seamless trading even during peak activity.

Solana Price Trajectory: Institutional Adoption and Technical Upgrades Fuel Long-Term Growth

Solana's SOL token trades at $174 amid sustained institutional validation and ecosystem expansion. The Layer-1 blockchain demonstrates accelerating adoption across DeFi, NFTs, and gaming sectors, with stablecoin partnerships and ETF speculation adding momentum.

Technical upgrades loom large in Solana's roadmap. The Alpenglow upgrade slated for Q4 2025 promises sub-200ms transaction finality and 10,000 TPS throughput, while Firedancer validator deployment enhances network resilience. These improvements coincide with shrinking exchange reserves (-10%) and record staking activity exceeding 60M SOL, creating potential supply-side pressure that could drive prices toward $280 by year-end.

Market technicians identify breakout potential beyond key resistance levels, with trajectory models suggesting $480-$555 ranges under favorable conditions. ARK Invest's staking products and R3's tokenization partnerships underscore growing institutional confidence.

Long-term projections remain bullish, with 2030 price targets clustering between $1,000-$2,000. Analysts highlight Solana's positioning in the PayFi sector as particularly compelling, where its architecture addresses payment infrastructure inefficiencies. Stablecoin volume growth—doubling since 2023—confirms the network's real-world utility beyond speculative trading.

Solana Surges Past $200 as Altcoin Season Gains Momentum

Solana (SOL) has breached the $200 mark with a 15% daily gain, signaling a potential altcoin season as the total crypto market capitalization eclipses $4.1 trillion. The sixth-largest cryptocurrency by market cap is now approaching its January all-time high of $295.83, this time supported by stronger fundamentals.

On-chain data reveals Solana maintains dominance in active usage despite slight declines in monthly users. Its ecosystem continues to attract capital across DeFi, NFTs, and gaming verticals, with weekly gains reaching 23%. Analyst Micro2Macr0 dubbed SOL the 'king of retail chains,' forecasting sustained upward momentum.

The broader market rally shows capital rotation into mid-cap tokens, creating conditions for explosive moves in select altcoins. Solana's leadership in this cycle underscores growing institutional confidence in blockchain utility beyond speculative trading.

Pump.fun Resumes SOL Deposits to Kraken as Price Nears $200

Pump.fun has resumed transferring SOL to Kraken after a pause, depositing 86,254 SOL as the cryptocurrency approaches $200. This marks the platform's first deposit since June 10, bringing its total SOL transfers to Kraken to 3.93 million across various price points.

The intermediary wallet used for these transactions is now empty, but Pump.fun retains at least 898,000 SOL in other public wallets. The move follows a temporary halt in PUMP buybacks, suggesting strategic positioning during SOL's price surge.

Market observers note the deposits don't necessarily indicate immediate liquidation, as the platform maintains significant SOL reserves. These could potentially support the PUMP token's liquidity in future operations.

Solana Tests Key Support Amid Market Pressure as Mining Platform Promises High Returns

Solana (SOL) faces intensified selling pressure after failing to hold above $185 resistance, with bears now pushing price toward the 200-period EMA on 4-hour charts. A breach of $165 support could trigger deeper correction territory.

SIX MINING positions itself as a beneficiary of volatile conditions, advertising daily yields up to $7,777 through staking contracts. The platform's promotional materials highlight a $12 signup bonus and sample returns of $7.20 on $100 two-day contracts.

Market dynamics show diverging forces - while network activity and mining participation could stabilize SOL's price, sustained capital outflows threaten further downside. The coming sessions will test whether institutional players accumulate at support levels or continue distributing holdings.

Solana Price Targets $270 Amid Institutional Adoption Surge

Solana's price surged past $200, marking a 15% intraday gain as institutional interest and technical patterns signal further upside. Analysts project short-term targets near $270, with long-term cup-and-handle formations suggesting potential rallies beyond $1,300.

CMB International's tokenization of a cross-border fund on Solana underscores growing blockchain utility. The asset manager's move follows accelerating DeFi activity and institutional adoption across Asian markets.

FARTCOIN Surges 26% on Solana as Whales Accumulate

FARTCOIN has rallied 26% to $1.06 amid surging whale activity, with on-chain data suggesting continued upside. Trading volume exceeded $650 million as Solana-based memecoin demonstrates unusual strength in a volatile market.

Nansen reports whales increased holdings by 2% to 207.42 million FARTCOIN. 'Large wallets are actively accumulating,' analysts noted, drawing parallels to early patterns seen in other successful memecoins. The buying pressure appears organic rather than speculative.

Smart money investors are following suit, adding positions after the initial breakout. This two-tiered accumulation—from both whales and sophisticated traders—often precedes extended moves in crypto assets.

Solana Breaks Past $200 as Institutional Buying and ETF Hopes Ignite Rally

Solana (SOL) surged 13% in the past 24 hours to breach the $200 psychological barrier, outperforming the broader crypto market's modest 2.71% gain. The rally reflects growing institutional conviction and speculative ETF demand ahead of regulatory decisions.

Public companies now control approximately 8% of SOL's circulating supply, with Nasdaq-listed Upexi Inc. disclosing a $316 million position. This institutional accumulation mirrors Bitcoin's pre-ETF supply squeeze, creating upward price pressure as liquidity tightens. Market participants await the SEC's October 2025 deadline for Solana ETF applications, which could unlock new capital inflows.

Technically, SOL's breakout above the $194.12 Fibonacci level confirms bullish momentum. The RSI14 reading of 61.59 suggests room for further appreciation without immediate overbought risks. Traders view the $200 breakthrough as validation of Solana's growing institutional adoption narrative.

Solana Surges Past $200 Amid Institutional Demand and Corporate Backing

Solana's SOL token breached the $200 threshold for the first time since late July, marking a 15.67% gain in 24 hours and a 23% weekly rally. The asset's outperformance dwarfs the broader crypto market's 4.2% uptick, with its market capitalization now at $108.59 billion.

Upexi Inc., a Nasdaq-listed firm, catalyzed the move by announcing a Solana-focused advisory board chaired by BitMEX co-founder Arthur Hayes. The company disclosed a $316 million SOL position and plans to expand its ecosystem involvement, triggering a 20% pre-market stock surge.

Institutional accumulation is tightening supply—public companies now control 8% of circulating SOL. Scarcity dynamics and speculation about potential U.S. Solana ETF approvals are fueling bullish momentum. Traders are monitoring whether SOL can sustain above the psychologically significant $200 level after briefly touching $205.87.

Solana (SOL) Breaks $200 Resistance Following CPI Inflation Report

Solana's SOL surged nearly 10% from its $175 support level, breaching a key bearish trendline to touch $199 amid renewed bullish momentum. The rally comes as traders digest favorable CPI data, with technical indicators suggesting potential upside toward $205 if the $200 psychological barrier is decisively conquered.

Whale activity introduces volatility - Alameda Research unstaked $35 million in long-locked SOL tokens, creating selling pressure that could test critical support at $170. The token now consolidates above its 100-hour moving average, with Fibonacci retracement levels indicating strong buyer interest at current valuations.

Will SOL Price Hit 300?

BTCC analyst Emma notes that SOL's path to $300 depends on three factors:

| Factor | Current Status | Required for $300 |

|---|---|---|

| Technical Resistance | Testing Upper Bollinger Band ($203.72) | Weekly close above $215 |

| Institutional Demand | Strong (per news flow) | Continued ETF speculation |

| Market Cap Growth | $88B | ~$120B needed |

While possible in this cycle, immediate consolidation near $200 is likely before another leg up.